Here's a number that will make your stomach turn: crypto transfers tied to suspected human trafficking networks surged 85% year-over-year in 2025, reaching hundreds of millions of dollars, according to Chainalysis.

—

And here's the part the headline-writers don't want you to think about — we only know that number because blockchain is transparent.

Try asking HSBC how much cash they laundered for cartels before they got caught. Try asking Deutsche Bank for a real-time ledger of every suspicious wire transfer. You'll get silence, redactions, and a fine that amounts to a rounding error on their quarterly earnings.

The traditional financial system doesn't produce these reports because it can't — not because the crime isn't happening there.

Loading tweet...

View Tweet

Transparency Is the Feature, Not the Bug

Every time a story like this drops, the regulatory reflex is predictable: crypto enables crime, therefore we need more surveillance, more KYC, more gatekeeping. But let's slow down and look at what actually happened here.

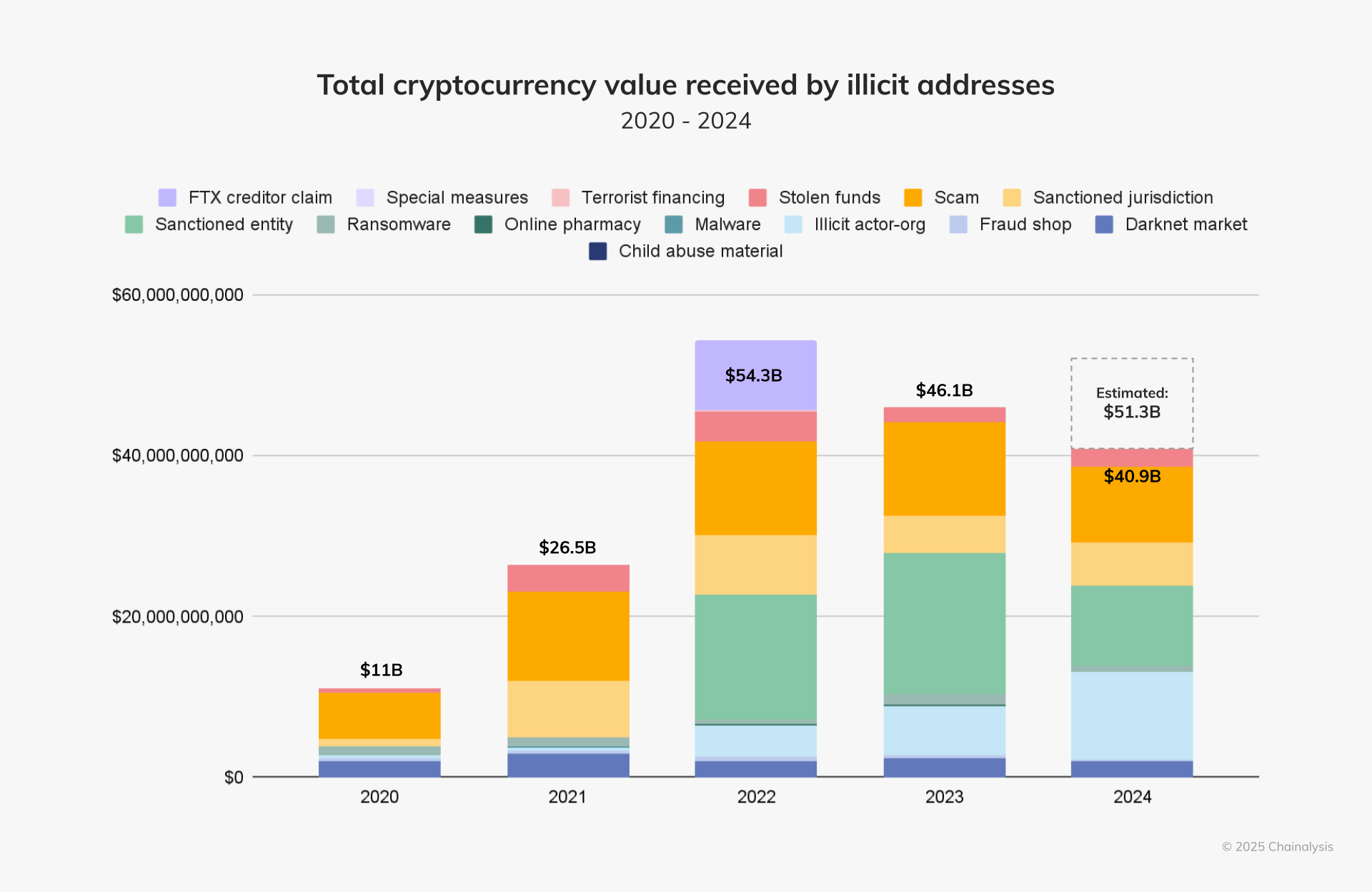

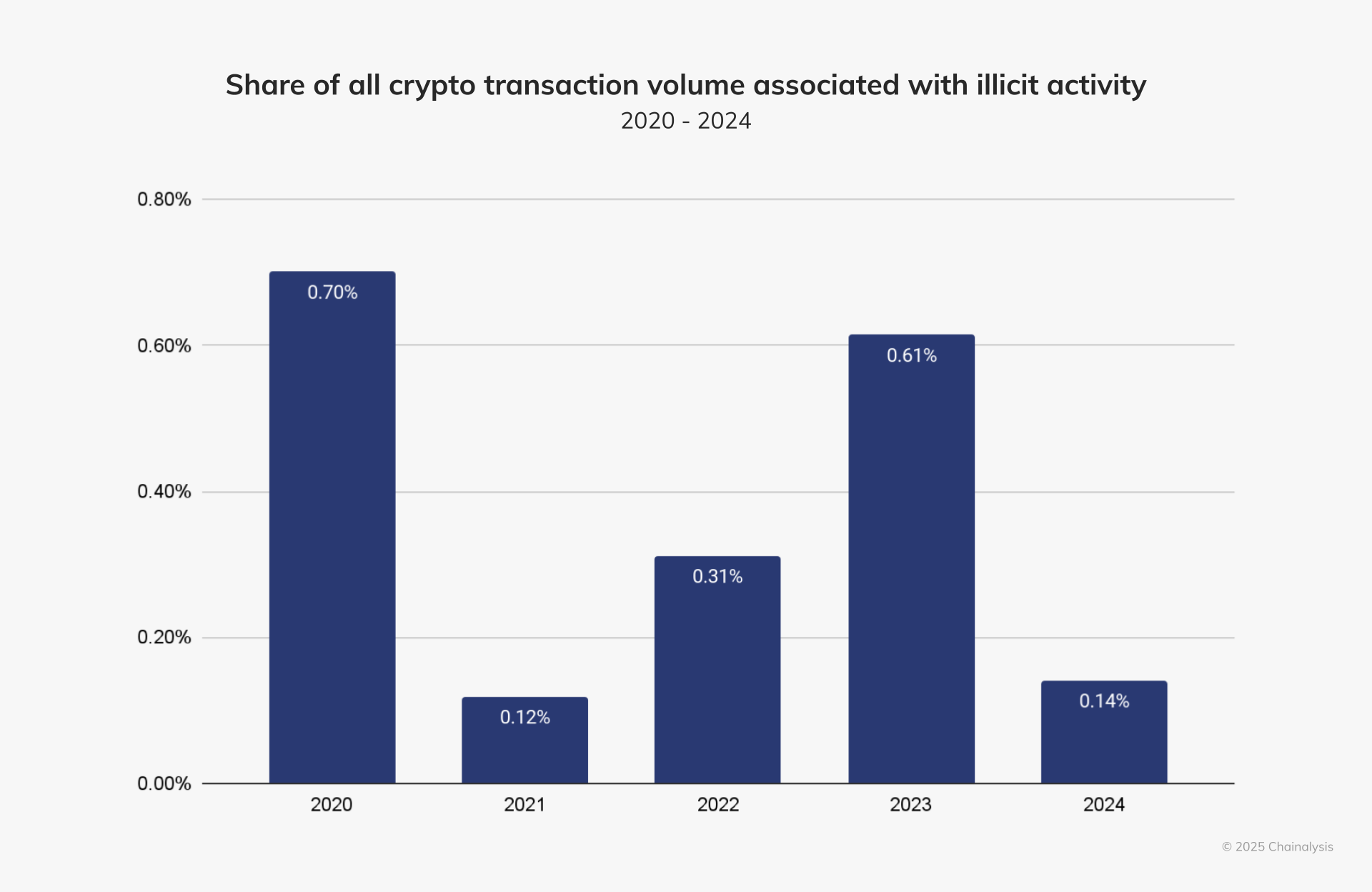

Chainalysis — a private blockchain analytics firm — identified suspected trafficking flows across multiple services using onchain data. That's the open ledger doing its job. No subpoena required. No five-year investigation. No whistleblower needed. The evidence is just... there.

Compare that to the estimated $150 billion annually that the ILO says human trafficking generates globally — the vast majority of which flows through traditional banks, cash, and hawala networks that are effectively invisible.

The 85% increase in detected crypto flows might reflect better detection tools as much as increased criminal adoption. When you build a better microscope, you find more bacteria. That doesn't mean the petri dish got dirtier.

What Crypto Natives Should Actually Support

Here's where I'll say something that might surprise the "no regulation ever" crowd: targeted cooperation between blockchain analytics and law enforcement to prosecute human trafficking is a good thing. Full stop.

This isn't about surveilling your DeFi swaps or flagging your self-custody wallet. This is about using the inherent transparency of public blockchains to catch people who enslave other human beings.

The cypherpunk vision was never about protecting monsters. It was about protecting individuals from unchecked state power.

There's a world of difference between:

Using on-chain forensics to trace trafficking networks and freeze their funds at centralized off-ramps — good

Using trafficking statistics as a pretext to ban self-custody, mandate universal surveillance, or kill privacy tools for everyone — bad

The distinction matters enormously. Criminals using crypto get caught because the ledger is public. Criminals using cash don't. The honest response to this Chainalysis data isn't to restrict crypto — it's to fund more blockchain forensics and point those tools at the off-ramps where traffickers convert to fiat.

The Real Question Nobody's Asking

If blockchain analytics can identify hundreds of millions in suspected trafficking flows, why aren't governments investing more in this capability instead of wasting resources trying to regulate DeFi front-ends?

The answer, as usual, is that combating actual crime is harder and less politically useful than expanding blanket surveillance over law-abiding citizens.

Crypto didn't invent human trafficking. Cash, wire transfers, and shell companies have fueled it for decades with near-total opacity. What crypto did do is accidentally build the most powerful financial surveillance tool ever created — a public, immutable, auditable ledger.

The irony is almost poetic. The technology built for freedom might be the thing that finally makes trafficking networks nowhere to hide.

Loading tweet...

View Tweet

Don't let anyone use the suffering of trafficking victims as a Trojan horse for surveillance. Demand targeted enforcement, not blanket control. The blockchain is already doing its part — now it's time for governments to use it properly.